The Shenzhen Institute of Economics and Management, Tsinghua University (Tsinghua SIEM) organized a forum online and in-person to solve the financing difficulties of specialized and sophisticated enterprises that produce new and unique products on November 20, 2022. The event was co-organized with the Executive Education Center of Tsinghua University School of Economics and Management (Tsinghua SEM) and the Institute for Global Private Equity, Tsinghua University. Experts and scholars from enterprises, universities, research institutes and regulatory departments met to discuss solutions for the enterprises. Professor LI Jizhen, associate dean of Tsinghua SEM, presided over the forum.

The forum discusses ways to help specialized and sophisticated enterprises produce new and unique products.

XIAO Xing, dean of the Department of Accounting at Tsinghua SEM and director of the Institute for Global Private Equity at Tsinghua University, said in her keynote speech that "hard technology" companies accounted for the majority of enterprises recognized as "specialized and sophisticated" in the past two years: their industries included manufacturing, enterprise services, medical health, and artificial intelligence. Based on a study of IPO trends in science and technology, XIAO Xing said the growth pattern of specialized and sophisticated enterprises requires a very long process from establishment to successful listing, and only a few enterprises can survive long enough to become publicly traded. At present, the overall success rate for financing of specialized and sophisticated enterprises is not high, and the financing proportions vary greatly by region and industry. XIAO Xing said entrepreneurs should consider the choice of the company's business location early on and focus on utilizing policy support of the local government, tap local scientific research and human resources, and whether other supporting facilities are sufficient.

Regarding how to seek financing solutions, XIAO Xing said specialized and sophisticated enterprises should seek a balance between technology and business. The venture capital team of any such enterprise usually comes from a technology background. After A Round Financing, the team should introduce more core members in management and keep an open mind. Different industries have different development patterns, and entrepreneurial teams must improve their management ability if they want to survive. Such enterprises should also diversity their financing options. In the early stage, they should seek more support from the government. After they have the ability to industrialize, they can seek capital and industrial investment from industrial capital . After they achieve commercial success, they can seek financial capital support. Very few companies ever get to an IPO, so they can also consider mergers and acquisitions (M&A) with complementary companies.

XIAO Xing delivers the keynote speech.

YANG Yuqing, the first-grade researcher of the Industry and Information Technology Bureau of Shenzhen Municipality, said in his keynote speech that the financing difficulties of small-and medium-sized enterprises (SMEs) are a long-term problem due to asymmetry between the supply side and the demand side. In terms of the demand side, SMEs' loan repayment ability is not strong, which is reflected in weak management ability, weak core competitiveness, low profitability, and weak risk resistance; in terms of the supply side, because of problems in systems and mechanisms, as well as efficiency and benefits, the will to supply is insufficient. A survey by the Industry and Information Technology Bureau of Shenzhen Municipality of specialized and sophisticated enterprises in 2021 found that bank financing difficulties were one of the main problems faced by SMEs.

YANG Yuqing also introduced Shenzhen's practice of exploring solutions to the financing difficulties of SMEs. In terms of direct financing, Shenzhen implemented the program for enterprise restructuring and cultivation for listing, established and improved the multi-level capital market, set up various state-owned venture capital funds, and explored financing channels for bond issuance. In terms of indirect financing, it also implemented an incentive plan for innovative financial service products in the banking industry, built a policy-based financing guarantee system, encouraged the development of small loan companies, took the lead in carrying out a pilot project for opening small loan companies nationwide, supported the establishment of private banks and rural banks, and established a credit enhancement financing platform and a compensation mechanism for risky non-performing bank loans. In addition, Shenzhen has tailored financing measures for specialized and sophisticated enterprises, including improving financing services, expanding indirect financing, reducing financing costs, strengthening equity investment, and supporting listing financing.

YANG Yuqing delivers a keynote speech at the forum.

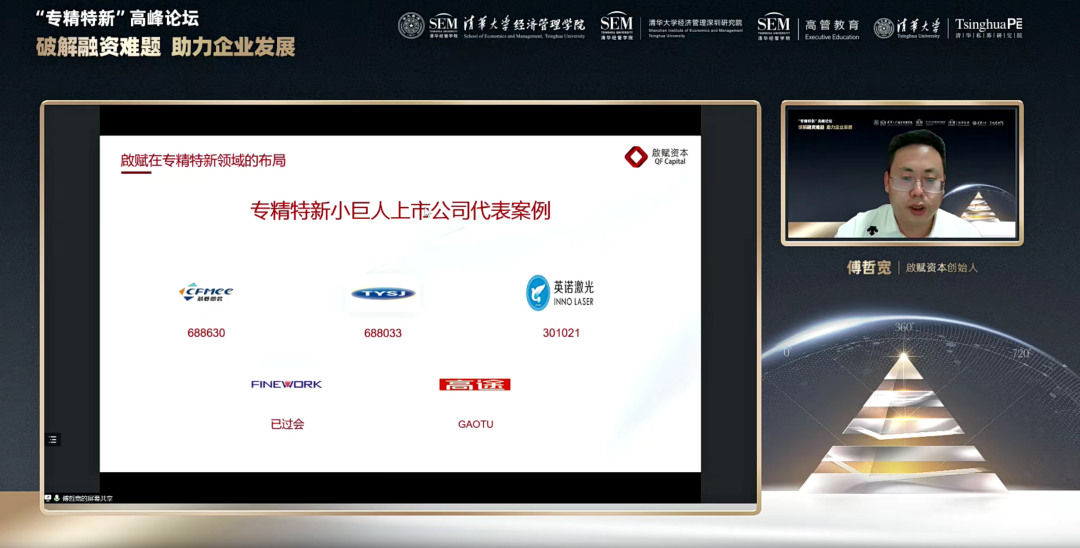

FU Zhekuan, president of QF Capital, said in his keynote speech that technological independence and an upgrade of manufacturing capability are the main themes of China's economic development, as well as a focus on investment in specialized and sophisticated enterprises. For investors, such enterprises that produce new and unique products have the following characteristics: the cultivation cycle is long, so they require investors to be patient and need value-added services after investment; after being recognized by the market, they develop rapidly and have diversified exit channels; and after becoming a specialized and sophisticated enterprise, the policy support will be strong.

FU Zhekuan introduced QF Capital's investment strategy for specialized and sophisticated enterprises. First, they find the right team to invest in, ensure the entrepreneurs are technical experts with engineering ability, that they can turn their idea into a good products, adapt to market demand, and have strong engineering and commercial skills. Second, they check if the market is large, and whether there is a possibility for the entrepreneurs to move from a professional market to a larger market. Third, they check if there are high industry barriers, including technical barriers and market barriers, that will allow them to maintain a market advantage. Fourth, they prefer platform companies, which can easily reflect the coordinated development effect of products, and can scale up or extend upstream and downstream, so this is more valuable. In addition, as an investment institution, they empower enterprises from various aspects of policy, technology, market, talent and capital operation after investment, so as to better promote the development of specialized and sophisticated enterprises.

FU Zhekuan delivers a keynote speech at the forum.

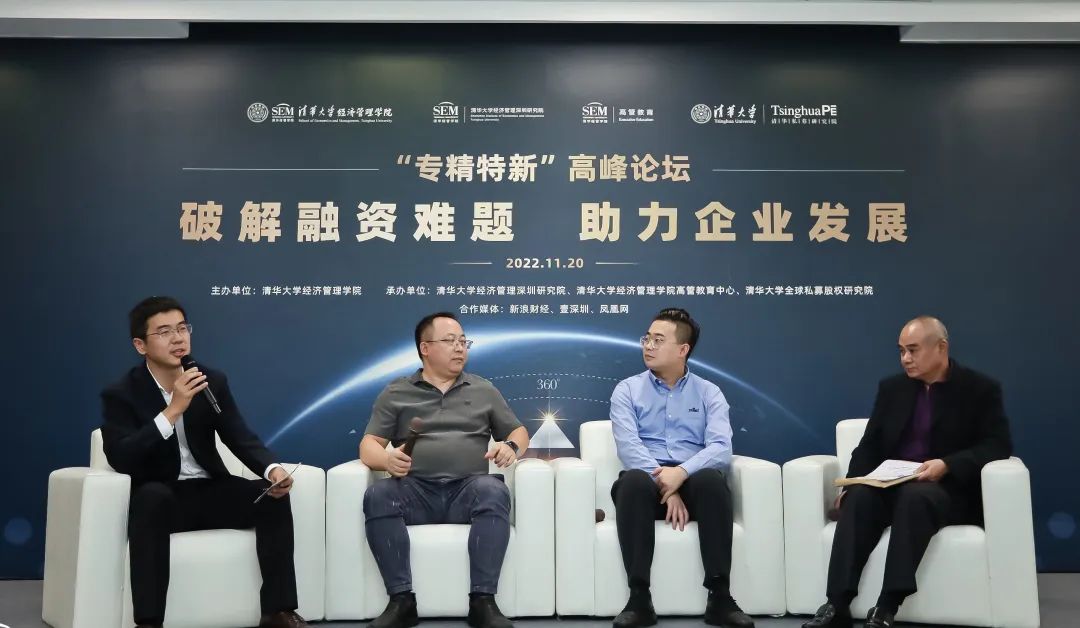

Subsequently, ZHANG Jun, managing director of China Merchants Wealth; YANG Yuqing, first-grade researcher at the Industry and Information Technology Bureau of Shenzhen Municipality; ZENG Xiping, executive vice president of Shenzhen Huake Chuangzhi Technology Co., Ltd.; and ZHAO Zhaohui, founder and CEO of Youibot Robotics Co., Ltd., participated in a roundtable discussion and conducted in-depth exchanges about financing specialized and sophisticated enterprises from the perspective of regulators, investors and enterprises.

A roundtable discusses ways to explore financing specialized and sophisticated enterprises from the perspective of regulators, investors and enterprises.

Editor:Tsinghua SEM